Navigating Gold Investments: A Strategic Approach for Savvy Investors

Introduction

Welcome to the latest edition of our newsletter, where we embark on an insightful journey into the world of gold investments. Join us as we explore the optimal timing for purchase and the compelling case for a five-year holding strategy.

When Is the Golden Moment? Unveiling Historical Insight

In the tapestry of time, certain moments gleam brighter than others for astute investors venturing into the gold market. Let's rewind to 2005/06, a golden era when the price of gold stood humbly at £250 per troy ounce. Those who recognized the signs early seized an opportunity that would set the stage for substantial gains.

Fast forward to the turbulence of 2007/08, marked by the UK banking crisis. Here, another window of opportunity opened as the gold price danced around £350 per troy ounce. Investors with a keen eye and a penchant for strategic moves found themselves riding the golden wave.

The unprecedented events of 2020 unfolded a new chapter. In the midst of a global pandemic and economic uncertainty, gold emerged as a resilient asset. Witness the ascent from £1,200 per ounce in April to a new all-time high of £1,574.37 per ounce in August of the same year.

These historical snapshots underscore the significance of timing in the world of gold investments. As we explore these insights, remember that hindsight offers valuable lessons. The question remains: Are you ready for the next golden moment?

Gold Price over the last 20 years

The graph provides a compelling narrative of the gold market's resilience and growth over time, showcasing a substantial journey from £217.05 per ounce on February 11, 2004, to an impressive £1,591.41 per ounce on January 8, 2024. The remarkable percentage increase of approximately 633% not only reflects the tangible increase in gold's value but also underscores its role as a reliable savings pot. This visual representation serves as a powerful testament to the enduring appeal and wealth-building potential that gold offers. For our valued clients, this graph underscores why gold stands as an excellent long-term investment. We invite you to consider gold not just as a precious metal but as a strategic asset for preserving and growing your wealth over the years.

The Five-Year Horizon: Unveiling Potential Rewards

1. Long-Term Wealth Preservation

Gold’s role as a wealth-preserving asset becomes more pronounced over time. A minimum five-year commitment allows investors to weather short-term fluctuations and tap into the enduring value that gold offers.

2. Strategic Positioning for Future Opportunities

In a world marked by dynamic economic shifts, holding gold for five years positions investors strategically. It provides the flexibility to capitalize on emerging opportunities while having a stable foundation in the form of precious metals.

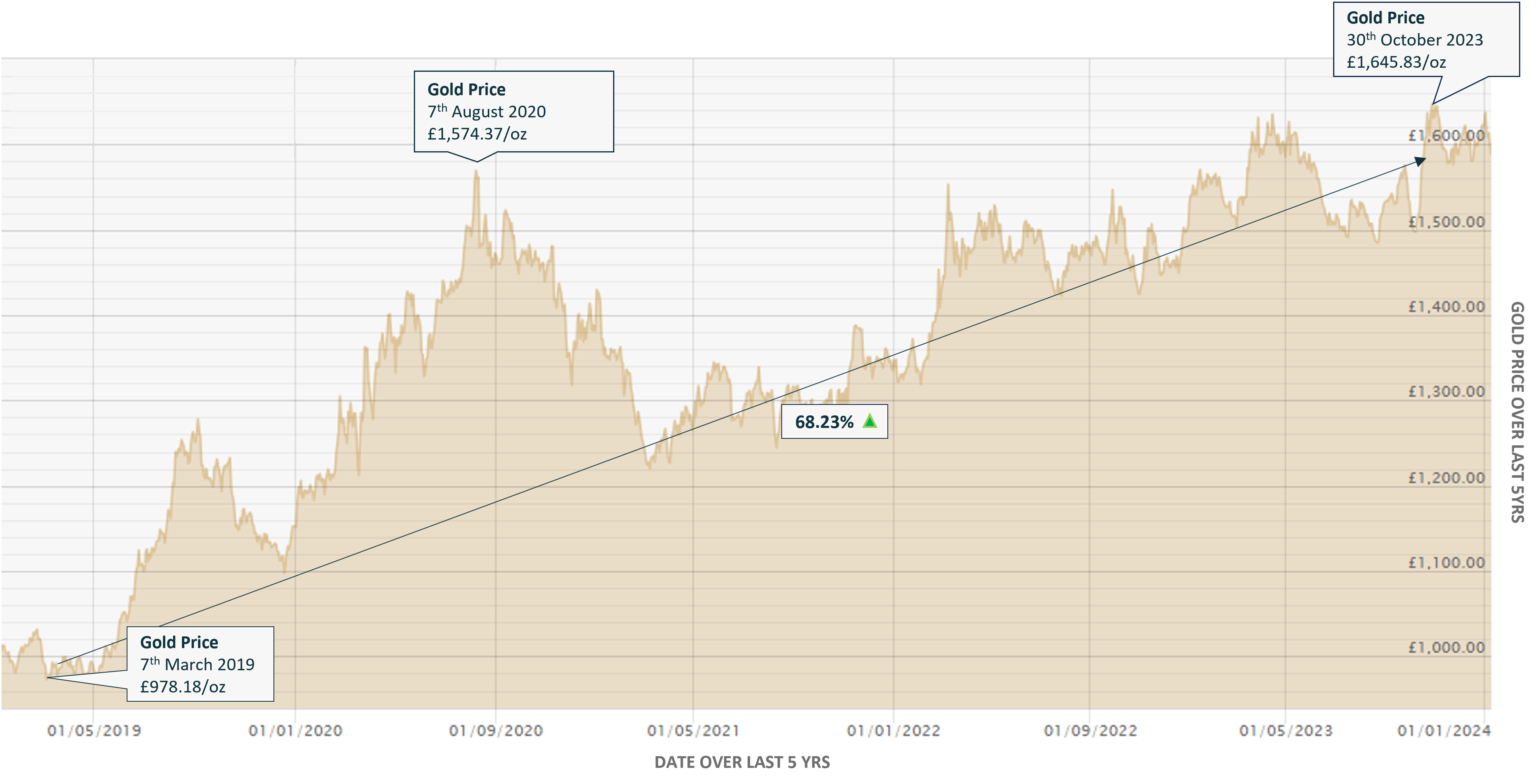

Gold Price over the last 5 years

This graph provides a visual narrative of the remarkable journey gold prices have taken from March 7, 2019, at £978.18 per ounce to October 30, 2023, reaching £1,645.83 per ounce. The visible 68.23% percentage difference encapsulates the compelling allure of gold as an investment. It reflects not only the tangible value appreciation but also the resilience and stability that gold brings to a diversified portfolio. This graph is a testament to the potential rewards that patient investors can reap over time. This visualisation stands as a testament to the consistent and reliable performance of gold over time, providing our clients with confidence in their long-term investment decisions.

Gold’s Resilience Over Time

1. Stability Amidst Uncertainty

Gold has long stood as a beacon of stability during times of economic uncertainty. Its intrinsic value safeguards against inflation and market volatility, making it a reliable anchor in diverse investment portfolios.

2. Historical Performance

Reflecting on the historical performance of gold reveals a consistent trend of long-term growth. Over the years, gold has proven its ability to preserve wealth and deliver substantial returns, making it a prudent choice for those with a longer investment horizon.

Global Economic Trends: A Strong Case for Holding Gold

1. Currency Devaluation Hedge

As central banks continue to grapple with economic challenges, the risk of currency devaluation becomes more pronounced. Gold, with its universal acceptance and intrinsic value, serves as a safeguard against the erosion of purchasing power over an extended period.

2. Diversification Benefits

Holding gold for a minimum of five years enhances portfolio diversification. Its low correlation with traditional assets, such as stocks and bonds, provides a valuable layer of risk mitigation, contributing to a more resilient investment strategy.

Conclusion:

In summary, the remarkable percentage increase showcased in the progression of gold prices underscores the dynamic nature of gold as more than just a precious metal — it emerges as a resilient and strategic asset, consistently yielding substantial returns.

Our recommendation for our clients to adopt a five-year investment horizon aligns seamlessly with the cumulative impact of these impressive percentage increases, portraying gold as a dependable savings reservoir. The upward trajectory that gold has shown in the last 20 years not only validates gold's resilience in the face of market fluctuations but also reinforces our position that a strategic, long-term approach to gold investments is both wise and fruitful.

For our esteemed clients, this document stands as a comprehensive guide, delving beyond mere percentage gains to emphasise the pivotal role gold plays in constructing a strategic, wealth-building portfolio. We extend an invitation to our clients to perceive these compelling figures not merely as numerical indicators but as a compelling reason to embrace a five-year hold. In doing so, we position gold as an integral cornerstone in their pursuit of enduring financial success, emphasising its appeal and capacity to significantly contribute to wealth accumulation over time.