Gold vs Property

The property market is generally known for its relatively stable growth as an investment, although it is not immune to periods of decline. For many individuals, property represents their most substantial investment, but it comes with the drawback of being entirely illiquid, meaning it cannot be easily converted to cash.

Amidst a cost-of-living crisis, a recession, and repeated interest rate hikes, households are facing increased financial pressure, particularly with mortgage prices on the rise. As a result, the outlook for the housing market in the UK is now projected to involve several years of falling property prices.

These economic challenges and uncertainties have created a difficult environment for homeowners and potential buyers alike, and market conditions may continue to be turbulent in the foreseeable future. As with any investment, it is crucial for individuals to carefully assess their financial circumstances and consider the risks involved before making decisions in the property market.

When it comes to gold vs property, many investors might be surprised at the results. Rental properties have long been touted as a go-to asset for large investments. As a physical asset of high value, and providing ongoing income for as long as you own it, property seems like a winning choice. The reality, however, is that recent changes in legislation have significantly reduced the potential returns a buy-to-let property offers. Another factor to consider - one that is often underestimated by many investors looking to become landlords - is the stress involved in managing one or more properties. With mismanagement, your investment in property could turn into a stressful nightmare - one that could even result in a loss.

A major hurdle to any property investment is the initial outlay. As of April 2019, the average house price in the UK is £228,903 – a significant amount of money even for a large investor. Unless you already have the capital available, you’ll need to borrow the money. A typical residential mortgage can be expensive at high interest rates, but a buy-to-let mortgage (a requirement when raising funds for rental properties) is even more so. The higher risk of buying a property for renting means tougher, and more expensive, restrictions are placed on them.

Buy-to-Let mortgages also require larger deposits; typically, this is around 25%, but can be higher. In our example “average house” this means a £57,225 deposit. Interest rates are also usually higher, but this may be offset by the higher deposit, which results in a lower loan-to-value ratio. Given the long time-frame for mortgages, interest rates are an important factor to consider. If rates increase, this will impact your repayments, and reduce your overall return. Taking on debt is always questionable for any investor, and increases the risk significantly.

The price of the house will not be the only cost when purchasing a property. Legal fees, estate agent fees, and surveys will add to your costs. Stamp Duty will also be a factor when purchasing a second property, and using our example “average house” this means a Stamp Duty of £8,945 - a significant loss to the start of your investment.

Once you have bought the property there will likely be one further cost: refurbishment. Most tenants when renting a property will expect a high quality of finish to the property. Even if all the building work is of sound quality, decorating and refitting kitchens and bathrooms can add thousands more to your costs. What seemed like a £228,903 house could easily cost you in excess of £250,000 – and by the time you finish paying off the mortgage, interest means this may be more than £300,000.

Having bought the property and found a tenant, it’s tempting to imagine the job is done. You can simply sit back and enjoy a steady rental income, right? A rental income of £800 pcm, and a mortgage payment of £500 pcm, would suggest a yield of £300 a month, but the reality is a number of small, hidden costs, can see this income squeezed further, or even result in a loss.

Property management is seen by some landlords as an interesting challenge, but for many the continual effort of collecting rent, performing inspections, and dealing with the issues that regularly crop up, is an unwanted hassle.

Unforeseen issues with the property, or troublesome tenants, could easily add to your costs. Landlord insurance is a smart way to protect yourself against these issues, but isn’t compulsory. As with all insurance, it’s a personal choice of whether you risk having it and not needing it, or needing it and not having it.

Investors who do prefer a hands-off approach can employ a property manager, who will see to the more mundane issues that may occur, but it will cost you more of your investment. Letting agents carrying out full property management services typically charge around 15% of rent collected – £120 of your monthly income in our example.

As time goes by the property will need refurbishment, and the general rule is to refresh the décor every ten years; keeping it fresh, clean, and (relatively) stylish to entice lodgers. On top of the cost incurred in doing this, every month that your property sits empty is a month of no earnings, despite potentially paying a mortgage, insurance, and agent fees.

This same risk for loss of earnings also applies to tenants. Whenever a tenant leaves, there will be time in which the property remains empty, and the longer it takes to find a new tenant the more it costs.

.

Rental income is taxable in the same way as income earned through employment, and the two are combined when calculating your income tax bill each year. If you collect £800 a month for a full tax year this will equate to an extra £9,600 income earned. If this were to push you into a higher tax bracket this will impact all your earnings, and should be carefully considered by any investor.

Landlords used to enjoy a certain amount of tax relief that somewhat countered this risk. Since April 2017 however, this tax relief has been reduced, and will be phased out by 2020. This means that by 2020 tax bills on rental income could increase significantly – dependent on income earned and your tax bracket.

When you decide to sell your property - whether because of high prices or you wish to release your equity - you will be faced with further costs. Estate agents and legal fees will once again reduce your profits, and further work may be required to bring the property to modern standards.

One of the biggest costs you will likely incur will be Capital Gains Tax (CGT); a tax paid on the profits made from the sale of assets. Full information on CGT can be found on the government’s official website, but for landlords especially CGT could cause a significant loss in profits.

For the financial year of 2019/20 the CGT allowance is £12,000. This means that if you sold your property and made £50,000 profit, £38,000 of this would be eligible for taxation. This is done at a rate between 10% and 28%, which could see your profits reduced by a significant amount.

One of the biggest risks in investment properties are house prices. High demand has helped keep house prices high in the past decade, but indicators have been worrying. London house prices have been dropping steadily – losing 2.6% in the past year – and often act as an advanced indicator for the wider market. Though still increasing, house prices for the rest of the UK have been stagnating, with growth for June only reaching 0.5% - down from 0.6% in May, and 0.9% in April. Analysts fear a house price bubble has been growing for some years, artificially boosted by the huge demand for property, and could be about to burst.

With the UK economy failing to grow, and Brexit still unresolved three years after the referendum, house prices could fall further still. Without the realisation of significant profits, the low rental income – and hard work – could seem like a poor reward.

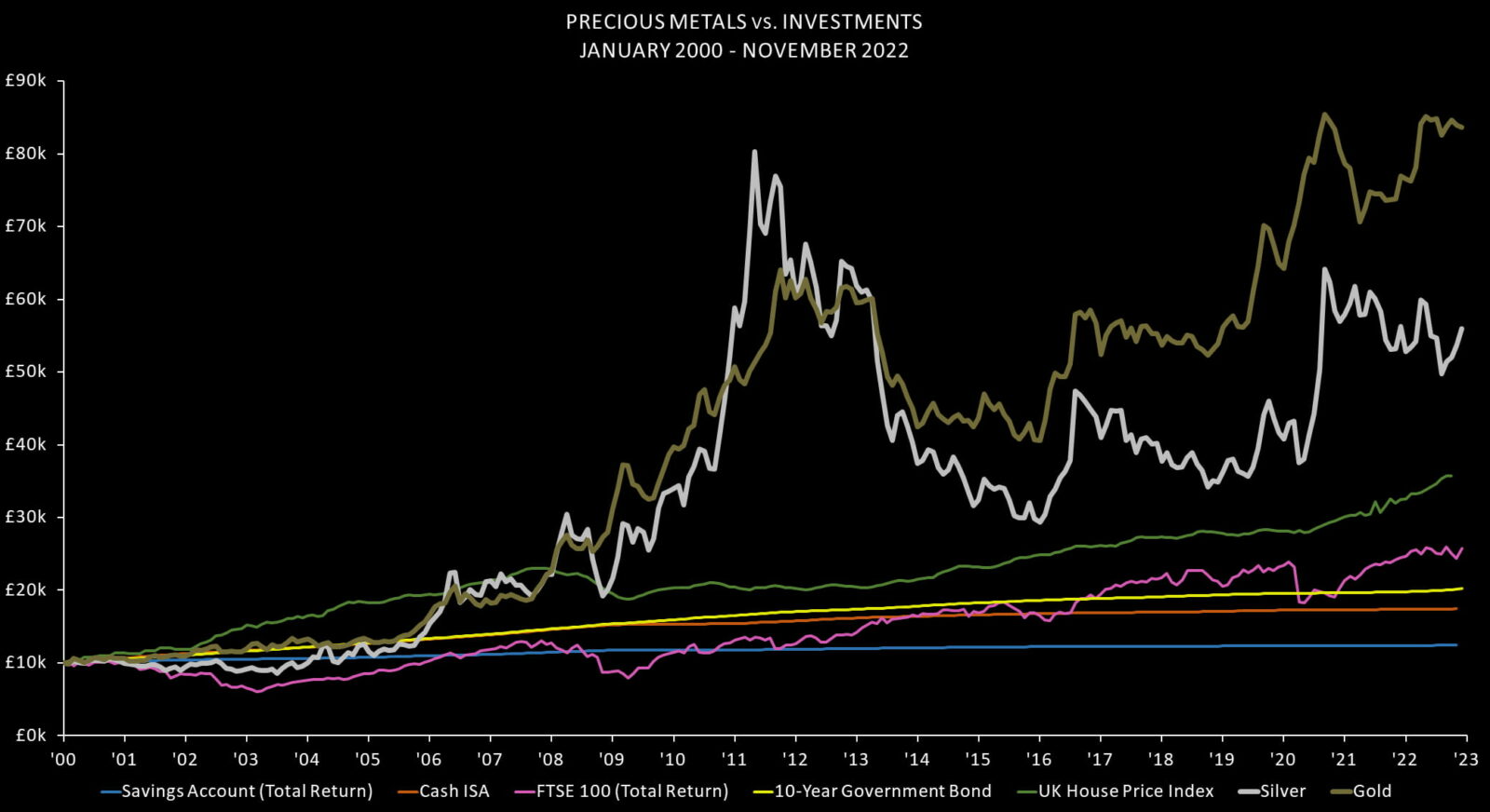

Over the past 20 years, both gold and silver have experienced significant growth and have outperformed other asset classes by a considerable margin. While most asset classes have managed to outpace inflation, the combined returns from gold and silver have been nearly four times higher than the average of other assets. On the other hand, money invested in a savings account over the same period would have lost value due to inflation.

To illustrate this point, consider the hypothetical value of an initial investment of £10,000 over 20 years in various assets:

- In a bank current account, it would be worth £11,822

- In a cash ISA, it would be worth £14,854

- In ten-year government bonds, it would be worth £17,369

- In the FTSE 100, it would be worth £41,195

- In residential property, it would be worth £23,775

- In silver, it would be worth £64,082

- In gold, it would be worth £66,758

As evident from these figures, the growth in physical gold and silver products has resulted in substantial returns, and depending on individual circumstances, they may not be subject to capital gains tax.

It is important to note that historical performance is not necessarily indicative of future results, and investment decisions should always be made based on individual financial goals, risk tolerance, and thorough research. Tax implications can also vary depending on individual circumstances and the tax laws in the relevant jurisdiction. As such, seeking advice from a financial advisor is recommended before making any investment decisions.

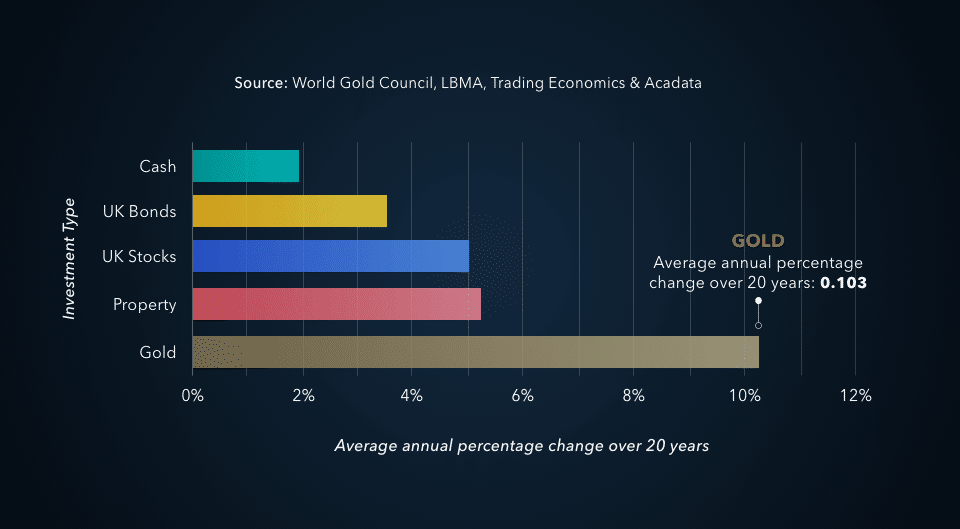

The graph below indicates the annual Percentage Change over 20 Years – Gold up 10.3% – Sourced from World Gold Council.

The graph below tracks how much an investment made in 2000 of £10,000 in gold or property (represented by the UK House Price Index) would be worth, tracked against inflation.

GOLD INVESTMENT IN MORE DETAIL

A HISTORIC GLOBAL CURRENCY

Gold, as a form of currency, has been traded for millennia. During the 17th century, goldsmiths played a pivotal role in shaping the modern banking industry. The rarity and versatility of gold make it a universally accepted currency and the ultimate wealth reserve. To safeguard against financial risks, central banks and countries are obliged to maintain a specific proportion of their wealth in gold.

BENEFITS OF GOLD AS AN INVESTMENT

Amidst periods of uncertainty, individuals tend to shy away from investing in the stock market or keeping their funds in banks. Nevertheless, physical gold has consistently served as a secure method of preserving wealth, with its value increasing in response to demand, as observed during both the 2008 and 2020 economic events. Discover how you can take advantage of these benefits.

Unlike shares or banking assets, ownership of gold does not require registration. As a result, physical gold remains one of the few forms of private investment that still offers this level of anonymity and privacy in today's financial landscape.

Acquiring physical gold serves as a discreet means of storing wealth, enabling clients to efficiently transfer assets to their loved ones, while being subject to the 7-year inheritance tax rule.

In times of inflation, gold’s value tends to increase in line with other products and commodities.

Seasoned experts highly recommend including gold in a diversified investment portfolio due to its tendency to appreciate in value during periods when other commonly held assets experience declines.

Throughout the 21st century, gold has proven to be one of the top-performing assets in the UK, showcasing an average annual growth of over 10% since 2000. In comparison, the FTSE 100 (Total Return) demonstrated an average growth of 4.5%, while property, represented by the UK house price index, saw an average growth of 5.7%.

Certain types of physical gold are free from any tax on growth depending on individual circumstances.

By converting your savings or pension into physical gold, you effectively eliminate it from the banking system, mitigating any potential counterparty risks associated with financial institutions. This move ensures that your wealth is secured in a tangible and independent asset.

Physical gold holds worldwide recognition and high demand, making it readily exchangeable for various global currencies, goods, or services. Its easily liquidated nature ensures that you can convert it into cash quickly and effortlessly whenever needed.

Unlike currency, gold cannot be simply created; its supply is limited, ensuring its enduring value. In fact, the total amount of gold in the world is relatively scarce, with enough to fill only two Olympic-size swimming pools. This scarcity contributes to its precious and coveted status.

A POWERFUL ASSET FOR THE FUTURE

According to the World Gold Council's forecast for 2023, the outlook appears mixed and uncertain, considering various scenarios such as weak global economic growth, a weaker US dollar, and geopolitical tensions. However, they suggest that, overall, these diverse influences are likely to result in a stable yet positive performance for gold throughout the year.

GOLD AND SILVER AS ALTERNATIVES TO TRADITIONAL SAVINGS

Numerous individuals opt to invest in gold and silver as an alternative to traditional cash savings for several compelling reasons:

- Hedging against Inflation: Precious metals like gold and silver have historically proven to be effective hedges against inflation. When the purchasing power of fiat currency declines due to inflationary pressures, the value of gold and silver typically rises, preserving wealth.

- Protection during Economic Instability: During times of economic uncertainty or financial crises, gold and silver often act as a safe-haven, providing stability and security for investors. Their intrinsic value and limited supply make them reliable assets in tumultuous economic environments.

- Diversification of Investment Portfolio: Including gold and silver in an investment portfolio can enhance diversification. These metals have a low correlation with traditional financial assets like stocks and bonds, reducing overall portfolio risk.

- Potential for Higher Returns: Over the long term, gold and silver have demonstrated the potential for significant price appreciation. While they might not yield regular income like dividend-paying stocks, their value appreciation can lead to substantial returns over time.

- Global Acceptance and Liquidity: Gold and silver are universally recognized and accepted across borders, making them easily exchangeable for various currencies or convertible to cash. Their high liquidity ensures quick and efficient transactions when needed.

- Timeless Value: Throughout history, gold and silver have been considered stores of value and a form of money. Their enduring allure and widespread use as a medium of exchange ensure their continued relevance in the modern world.

- Overall, investing in gold and silver can offer a sense of security, a means to safeguard wealth against economic challenges, and the potential for long-term financial growth.

INSURE YOUR SAVINGS AGAINST INFLATION

The example from 1920 clearly illustrates the enduring purchasing power of gold compared to currency over time. While a £20 note today may not be sufficient to cover a week's electricity bill, the 1oz gold coin can still pay for a week's rent. This demonstrates how gold has preserved its value, while the purchasing power of currency has steadily eroded due to inflation.

Given the relatively low interest rates (around 2-3% or even less) currently offered by savings accounts, some investors may question the wisdom of risking their hard-earned savings in these accounts. In an environment where inflation can outpace the interest earned, the real value of money stored in savings accounts can gradually diminish.

As a result, many individuals turn to gold as a means of safeguarding their wealth against inflation and economic uncertainties. Gold's historical resilience as a store of value and its potential for long-term growth make it an attractive option for diversifying investment portfolios and preserving purchasing power.

Ultimately, the decision to invest in gold or any other asset should be based on individual financial goals, risk tolerance, and the overall investment strategy. Consulting with a financial advisor can help you make informed choices that align with your specific circumstances and objectives.