INFORMATION PROSPECTUS

A WORD FROM THE CEO

"Our focus is optimising the customers' experience, we have designed a platform that enables customers to buy and sell Gold and silver bullion easily and securely.

It's the family feel that I enjoy most about what we have built so far, every individual has had a key role to play in the company's success."

Malcom Rouse, CEO

"The desire of gold is not for gold.

It is for the means of freedom

and benefit "

Ralph Waldo Emerson

VC Bullion

Rapidly Developing Brand

VC BULLION is dedicated to providing customers with the information they need to fully explore the metals market.

"Been working with VC Bullion for the last couple of years.

Always keeps me informed and really does know the market.

Looking forward to continuing working with them.

Keep it up, sit back and watch my assets grow!"

Google Review

Valued Client

Introduction to Investments in Gold

Buying one troy ounce of gold in 1970 and holding on to it until now would yield a 5,333 percent return!

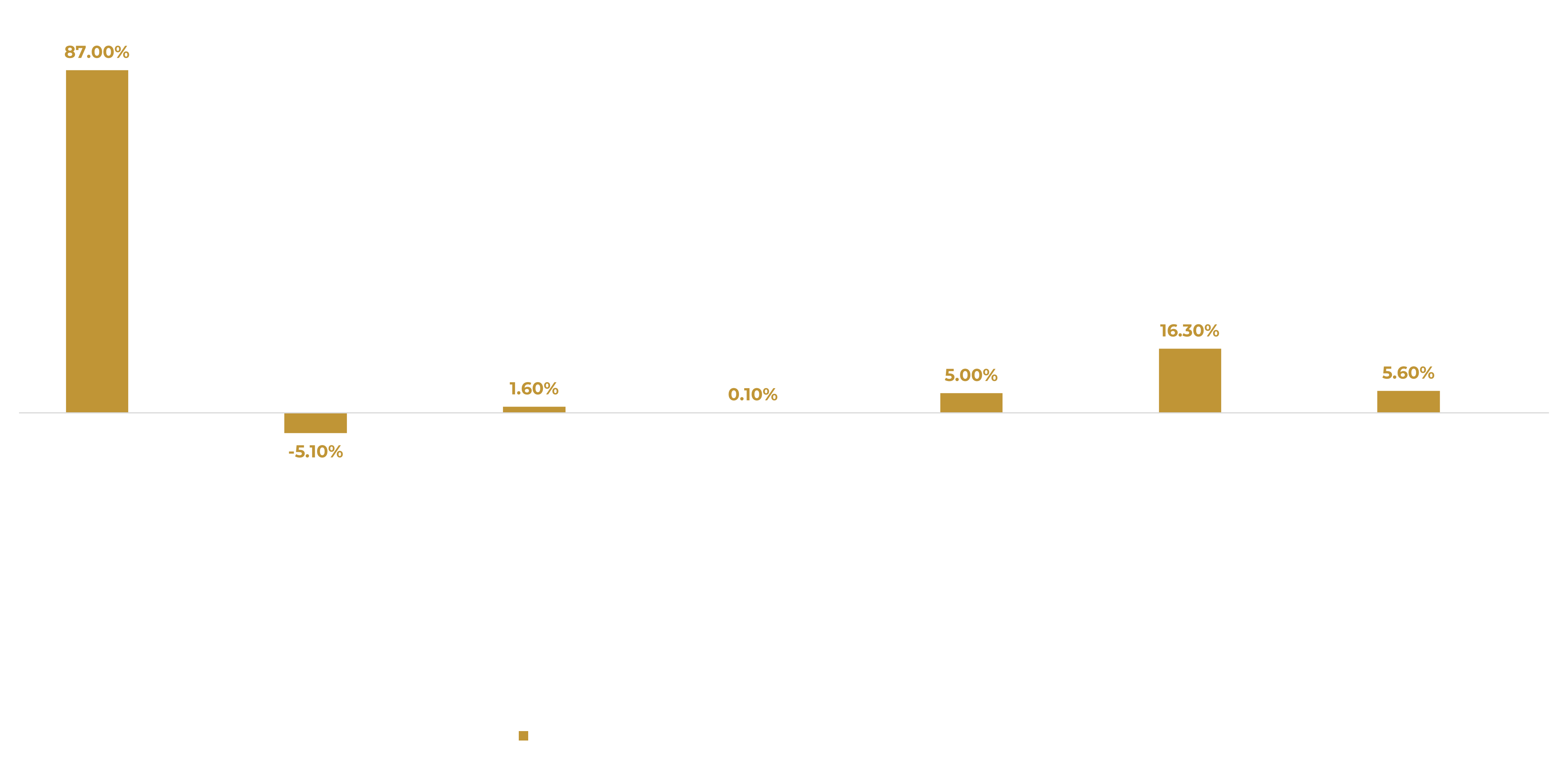

10.6%

Gold is the safest asset when

all markets are falling

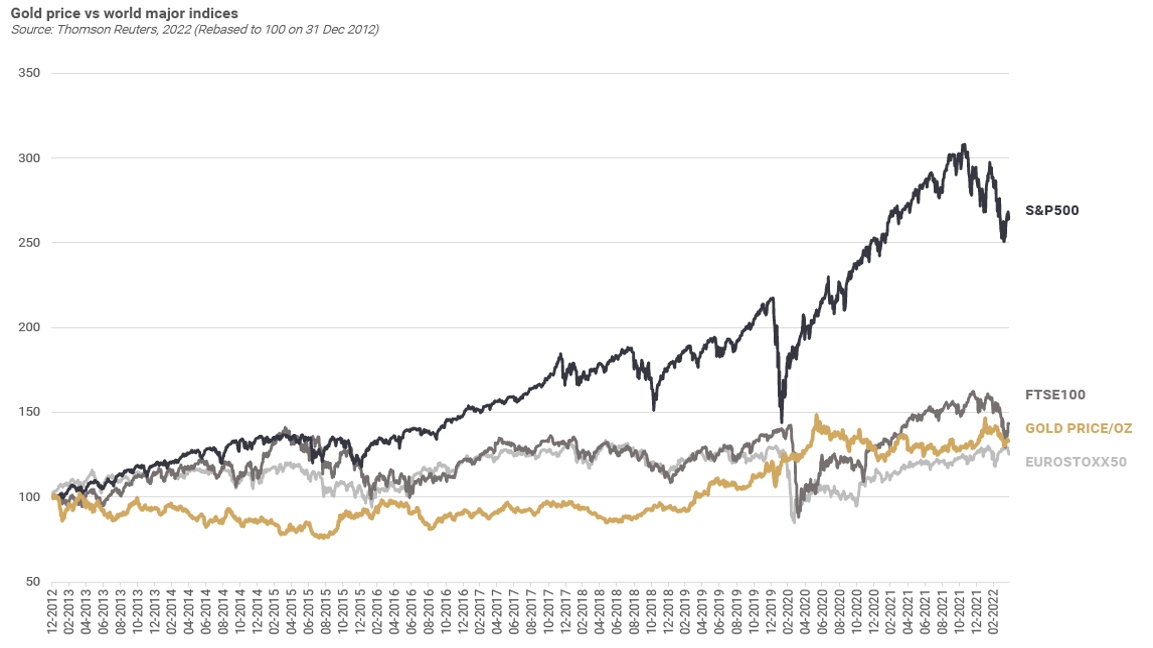

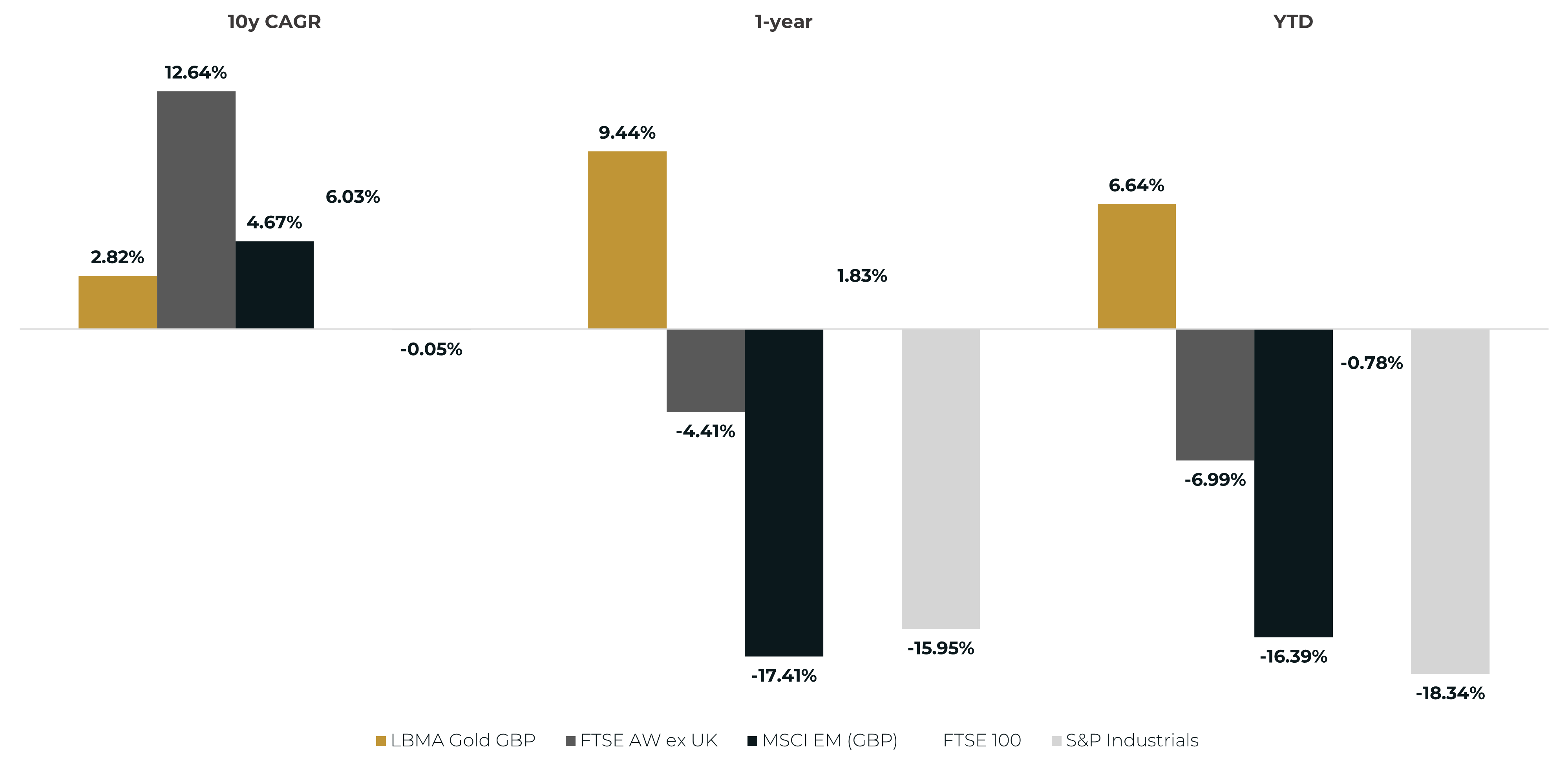

Then, if we only consider the years 2021 and 2022, gold has outperformed stocks as geopolitical uncertainty and inflation increased worldwide.

Gold is less affected by recessions

ROI In the Next 5 Years

£8,000

Potential ROI After 5 Years Based on a 20% Average Return per Annum

Top 4 Investments

1oz GOLD BRITANNIA

GOLD SOVEREIGN

COLLECTABLE COINS

100G GOLD BAR

Gold performance forecast

How to get started?

VC Bullion offers an easy 3-step process to manage your investments.